Charlie Brown Goes to Wall Street

- by Kevin Reardon

Have you seen the Charlie Brown episode where he takes the gang to Wall Street?

The gang's lemonade stand had a record year and they wanted to learn more about investing before they invested their 401k accounts. Charlie Brown took his good pals Lucy, Patty, Linus, Violet, Pig-Pen and even Snoopy (who has donned sunglasses and is impersonating a seeing eye dog as animals are otherwise barred from the trading floor) to Wall Street. As luck would have it, the top economist on Wall Street was there and would be providing their forecast for the coming year. When this economist spoke, people listened.

The gang's lemonade stand had a record year and they wanted to learn more about investing before they invested their 401k accounts. Charlie Brown took his good pals Lucy, Patty, Linus, Violet, Pig-Pen and even Snoopy (who has donned sunglasses and is impersonating a seeing eye dog as animals are otherwise barred from the trading floor) to Wall Street. As luck would have it, the top economist on Wall Street was there and would be providing their forecast for the coming year. When this economist spoke, people listened.

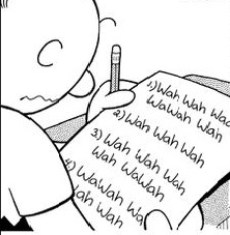

Charlie Brown excitedly pulled out his notepad to record every word. Linus put down his blanket. Lucy stopped yelling at everyone. And Snoopy sat at attention. The economist stepped to the podium, and began: “My economic forecast for the coming year entails…wah WA Wah!!” The disappointed gang tuned out when they realized that the ‘adult in the room’ had little practical information to share.

If you turn on CNBC, read The Wall Street Journal, or have the misfortune of being cornered at a cocktail party by an economist, you’ll notice after 90 seconds that they really aren’t saying anything relevant. They pontificate with great authority about China, Greece, exports, wages, unemployment, the trade deficit, interest rates, the price of oil, Congress, blah, blah, blah. It’s like Charlie Brown in real life. Economists and investment managers aren’t providing information we can truly rely on to make investment decisions. They are simply babbling.

No one can predict the movements in the markets in the short-term (less than 2 years). No one.

We know that markets go up over time; yet, we spend so much time and energy worrying about the day-to-day movements of the market, as if we could control the movements.

Wouldn’t it be great if we could approach investing in a more scientific way? Think of a chemist working in a laboratory who has proven a specific theory. Given enough samples they know their theory works a high percentage of the time, or potentially every time. This ‘proof’ allows them to make concrete decisions, without doubt. In much the same way, Shakespeare’s Investment Philosophy embraces four factors of return that have been proven to work over time. These proven factors of return allow us to have the same confidence in investing that a scientist would have working in a laboratory. These factors of return (simplified to show the main points) are:

- Equities outperform other asset classes.

- Small caps outperform large caps.

- Value companies outperform growth companies.

- High profit companies outperform low profit companies.

While these factors have been proven to work over time, they don’t work each year.

We build portfolios using these proven factors and know that over time they increase performance while lowering risk. There is no need to worry about the short-term ups-and-downs of the market. To place confidence in this is truly liberating.

No more listening to CNBC and the ‘experts’ who predict volatility because of (and please notice the conflicting points they spew at us):

- High oil prices

- Low oil prices

- Low interest rates

- Rising interest rates

- A weak dollar

- A strong dollar

- Strong China

- Weak China

- Democrat

- Republican

- blah, blah, blah…

So, what do we think the markets will do this year? We have no idea! Hopefully this answer made it through your Charlie Brown filter.

However, we do know for certain that there are proven factors that increase performance while decreasing risk, over time.

Because we are using these factors throughout client portfolios, we don’t let the monthly fluctuations influence our long-term investment decisions.

In 2016, let’s focus on these proven factors of return and tune out the ‘talking heads.’

Doing this, we can invest with confidence - which brings us all peace of mind.

It’s like Linus’ security blanket wrapped around your portfolio.