Posts Tagged ‘assets’

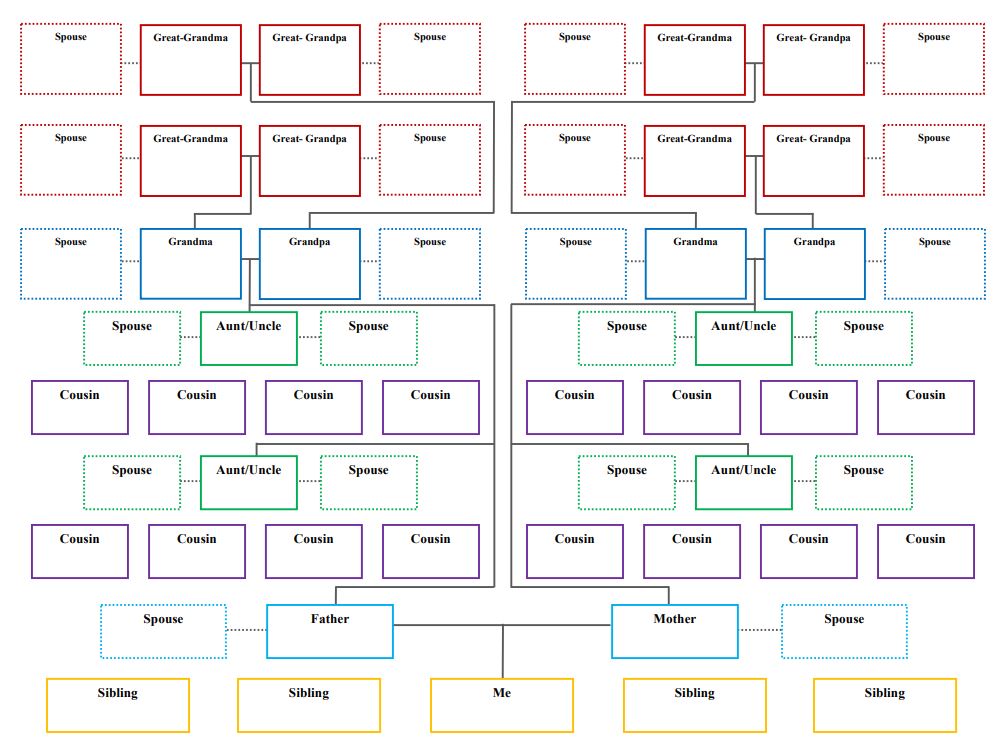

Guest Blog: Estate Planning for Blended Families

Estate Planning for Blended Families Written By: Bill Lyne, Lyne Law Firm, LLC When two people get married and one or both have children from a prior relationship, a “blended…

Read MoreEstate Planning at Different Stages of Life

By Kevin Reardon CFP® Different Life Stages Require Different Types of Estate Planning When I started my career, there was an overriding belief that Estate Planning was just for ‘rich people.’…

Read MoreRetirement Spending: There are Trade-Offs

By Kevin Reardon CFP® You have worked your whole life, saved well, and are ready to retire. It’s important to know how much you can pull from your assets during retirement…

Read MoreAre Value Stocks Poised for a Comeback?

Top Ten NON-Tax Estate Planning Tips

By Brian Ellenbecker CFP®, EA®, CPWA®, CIMA®, CLTC® Historically, planning to avoid paying estate tax when you pass away was a top-priority discussion for many families. However, estate taxes…

Read More