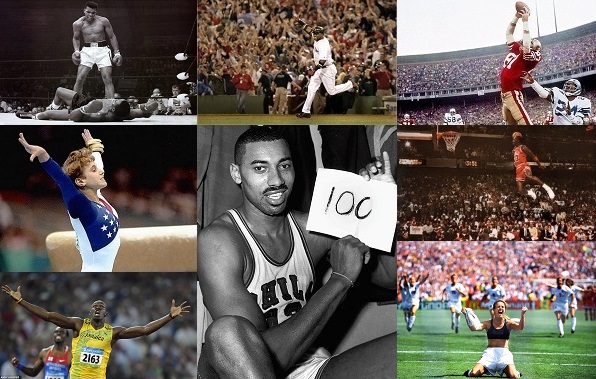

An elite athlete trains all year, for years at a time. They are physically able to do things that most of us can only dream of. Throughout the course of each season, they consistently perform at a high level to help their team. Yet, it’s not uncommon for their ultimate success to come down to a key play during the course of one or two games. To think that a lifetime of hard work can result in defeat if they aren’t ready for the few key plays seems unfair. When will the key play happen? How will they react? What can they do to prepare?

An elite athlete trains all year, for years at a time. They are physically able to do things that most of us can only dream of. Throughout the course of each season, they consistently perform at a high level to help their team. Yet, it’s not uncommon for their ultimate success to come down to a key play during the course of one or two games. To think that a lifetime of hard work can result in defeat if they aren’t ready for the few key plays seems unfair. When will the key play happen? How will they react? What can they do to prepare?

Much like an elite athlete, our financial success (or failure) can occur at critical junctures in our life. The tax code can both help and hurt us during these major life transition points. Some of the most common transition points in which taxes can have an impact relate to our career, being widowed, selling a business, retirement, and more. To think that our net-worth and financial independence could be significantly impacted if we don’t handle these transition points well is frightening. Let’s dig into each of these scenarios with the objective of helping you best prepare for them.

How your Career affects Taxes

There are various career stages you’ll experience in the workforce, from an entry level job to the apex of your career. As we enter the workforce, a key decision related to both taxes and future wealth relates to your decision to contribute to a retirement account. By contributing to a plan at a young age and in a meaningful way, you’ll be able to minimize your tax liability and maximize future wealth as a result of the tax deferral provided from these plans.

If you switch jobs throughout your career, it’s critically important that you handle the rollover of retirement assets properly. If you take these funds directly, you’ll pay income tax on the proceeds, as well as significant penalties if you’re below age 59 ½. Be sure to roll these assets directly to an IRA or 401k account.

Tax Planning as a Widow

Losing your spouse is both a traumatic life event and something that will impact your tax situation. You’ll need to file an Individual tax return in the years that follow the loss of your spouse. You may end up paying higher taxes as a result, for several. First, the federal tax brackets are more favorable to joint tax filers, relative to single filers. In addition, you will have one less exemption to claim and the itemized deduction phase-outs are lower for single tax filers.

One positive tax aspect from being widowed is the step-up in basis rule that allows you to increase the cost basis on any assets owned by your spouse to the value on the date of their death. The tax savings can be substantial.

Retirement & Tax Planning

You will face several critical issues during your non-working years that will impact your taxes and overall financial well-being. Immediately upon retirement, you will have the ability to roll your retirement plan at work to an IRA. If not done properly, this can result in a large tax liability and loss of both the tax deferred growth and asset protection features of retirement accounts.

If you have a pension fund, you’ll need to take either a lump sum distribution (large tax bill), roll your lump sum to an IRA, or take a lifetime pension. Each decision will have an impact on your overall plan. The correct choice is dependent on your personal situation, financial goals, other income sources, and distribution options within the pension. In most instances, taking a lump sum distribution is the worst option.

Social Security & Tax Planning

Deciding when to start taking Social Security income is a critical piece of everyone’s financial puzzle and taxes must be considered. For someone who is still working, starting Social Security before your full retirement age is rarely the right decision. Quantifying your other income sources in retirement will impact the extent your Social Security benefit will be taxed.

Required Minimum Distributions (RMDs) begin at age 70 ½, when the government forces minimum distributions from retirement accounts. If you are a diligent saver and have a relatively large retirement balance, the RMDs can cause a large tax liability. When coupled together with your other income sources (Social Security, Pension, Capital Gain and Interest Income, and any other income), it’s likely your RMDs can push you into a higher tax bracket. It’s possible to facilitate partial IRA withdrawals prior to age 70 ½ to minimize future RMDs.

Tax Planning for Business

Owning a business provides various tax saving opportunities. The owner frequently has the ability to implement a retirement plan, providing them the ability to defer taxes. In addition, they may expense various costs associated with running the business. As income taxes are higher than capital gains taxes, business owners may reduce their income taxes via additional business investments (expenses) with the goal of maximizing the intrinsic value of their business. Upon the sale of the business, the gains are frequently taxed at the lower capital gains rate, providing a tax arbitrage that can be meaningful.

Selling a business can have a significant tax impact on your overall financial well-being. Frequently you can choose between an outright sale or an installment sale over a period of years. Although both scenarios have strengths and weaknesses, an installment sale can stretch the tax liability over a number of years and may result in fewer taxes being paid.

Tax planning at various stages of life can have a large impact on your overall financial plan. Whether you’re starting out in your career, switching jobs, recently widowed, entering retirement, or selling a business, it’s critical that you make informed decisions relative to the choices available. If you are approaching a major life transition point, consult a seasoned financial advisor who can guide you through each transition point, and do it within the context of your long term financial plan.