How to Read Your Tax Return

Updated April 2024

In addition to the financial planning and investment management we are always busy with, we’ve also been fielding many tax questions from clients and CPAs. We aren’t saying we have it as bad as CPAs, but our phones have been ringing too!

Even if you hire a professional to prepare your taxes, just gathering all the tax forms you need and completing your accountant’s tax organizer can be exhausting. We've helped several clients work their way through the tax organizer and the various 1099s, W2s, and charitable donation documentations. Soon we’ll start to receive completed returns from our clients, which we will use to update financial plans.

It’s worth taking a quick look to understand some of the key items while also verifying the accuracy. Understanding this information can give you a better handle on your financial situation and may help you make better financial decisions—particularly when it comes to taxes.

Most Common Forms

Form 1040 and Schedules 1, 2, 3, A, and D

Form 1040 has just two pages and contains the final numbers that are used to calculate your tax liability. The Schedules that come after the 1040 contain supplemental data and calculations that feed into the 1040. In this blog post, we will highlight the items you typically want to pay close attention to.

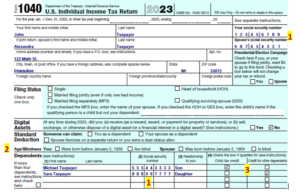

Form 1040

The vast majority of your key tax information is found on Form 1040. For the 2023 tax season, there are two versions of Form 1040: Form 1040 and Form 1040 – SR. 1040-SR is designed for seniors. The only difference is that the font is larger, so it is easier to read. The larger font also makes the form longer—it takes up three pages instead of two.

Form 1040 will summarize your income sources, deductions, tax owed, credits, and your refund or amount owed. Additional schedules and forms provide more details for many of the lines.

The first part of Form 1040 includes personal information for yourself and any dependents.

1 - It’s important to verify your personal information, but pay particular attention to the Social Security numbers on your return. If your SSN is incorrect, your return will either get rejected immediately or, if it’s accepted, you will need to file an amended return to correct the error.

2 - If you or your spouse are over age 65 or legally blind, your standard deduction is increased for each box that is checked in the Age/Blindness Section. Married couples receive an increase of $1,500 per box checked, while single filers receive $1,850.

3 - If you have dependents that qualify for either the child tax credit or the credit for other dependents, those individuals should be listed in the Dependents section. The appropriate credit box should be checked based on your relationship to them and financial support you provide. The amount of the credit is listed farther down the form on line 19.

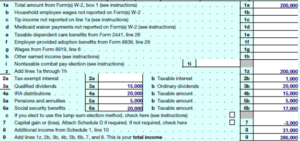

Income

Form 1040 Lines 1-9 are used to report your income sources for the year.

Line 1 reports your taxable wages from form W-2 (most common form of employment income). Income from deferred comp payments, including non-governmental 457 plans and from employer equity awards (stock options, restricted stock, SARs, etc.), are also reported on Line 1.

Line 2 reports interest income. Line 2a reports tax-exempt interest, which is typically interest earned from municipal bonds. While this interest isn’t taxable under the regular tax calculation, it could be taxable if you are subject to the Alternative Minimum Tax (AMT). It is also reported to the Social Security Administration and is used to determine whether or not you need to pay more in Medicare premiums due to high income. Line 2b reports taxable interest. Common sources or interest income include checking and savings accounts, money markets, CDs and individual bonds.

Note: Income included on line 2 is typically reported on a 1099-INT.

Line 3 reports dividend income. Qualified dividends meet special criteria to be taxed at lower tax rates and are reported on Line 3a. Qualified dividends are typically paid by individual stocks, mutual funds or ETFs that are based in the US. Line 3b represents total dividends.

Note: Income included on line 3 is typically reported on a 1099-DIV. Do you have a taxable account with stocks, ETFs or mutual funds? If so, you probably should see a number on line 3. This can get missed if you didn’t give your tax preparer the 1099 for this account. Don’t forget to check for 1099s delivered electronically.

Line 4 reports IRA distributions. Line 4a shows your gross distributions, while Line 4b is the amount from line 4a that is taxable. If you are over 70.5 and used your IRA to make a qualified charitable distribution (QCD), the QCD amount would be shown on Line 4a, but not Line 4b. You would also see the letters “QCD” written in the margin on that line.

Note: Income included on line 4 is typically reported on a 1099-R.

Tax Planning Note: If you made any charitable gifts from your IRA (QCD) make sure that Line 4b is less than 4a. This often gets missed because QCDs are not reported to you by your IRA custodian on your 1099-R or any other tax form. You must keep track of that information on your own and provide it to your accountant each year to ensure you receive the tax benefit you are entitled to.

Line 5: Withdrawals from qualified employer retirement plans, such as 401(k)s, 403(b)s, 457s sponsored by tax-exempt organizations, and pensions are reported on Line 5 along with distributions from annuities.

Note: Income included on line 5 is typically reported on a 1099-R.

Line 6 contains Social Security benefit payments. Not all of your Social Security benefits are subject to Federal income tax. Line 6a lists the gross amount you received. Line 6b lists the taxable amount.

Note: Income included on line 6 is typically reported on Form SSA-1099.

Line 7 reports your net capital gain or loss. Capital gains and losses are created when securities or other capital assets are sold throughout the year in taxable accounts. Typically, Schedule D and Form 8949 will also be required to report the details of your transactions for the year.

Note: Schwab reports this information in the 1099 Composite and Year-End Summary.

Tax Planning Note: Your net gain or loss on Line 7 is NOT an indication of your account performance for the year. In fact, realizing capital losses when available is a favorable tax planning strategy.

Line 8 reports miscellaneous income included on Schedule 1.

The most common items reported on Schedule 1 include self-employment income from Schedule C and rental real estate and passthrough income from Schedule E (partnerships, S-corps, estates, and irrevocable trusts), unemployment compensation and alimony.

Line 9 is your total gross income prior to adjustments.

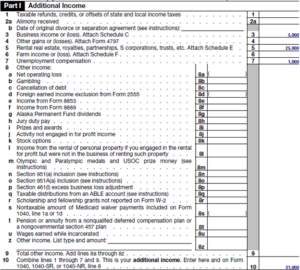

Adjusted Gross Income

Line 10 includes deductions listed on Part II of Schedule 1.

The most common deductions taken include contributions to Health Savings Accounts (HSA), deductions for the self-employed individuals (self-employment taxes, contributions to retirement plans and health insurance), alimony paid and student loan interest.

Tax Planning Note: If you contribute to your HSA through payroll deductions, the reduction in income will be reported through your W2. You typically won’t report an HSA deduction on Schedule 1.

Subtracting the deductions from your gross income on Line 9 determines your Adjusted Gross Income (AGI), which is shown on Line 11. AGI is an important number which is used for many things, including:

- Eligibility for certain deductions or credits

- Ability to deduct IRA contributions

- Ability to make Roth IRA contributions

- How much of your Social Security is taxable

- Determining if you are required to pay more in Medicare premiums

- Eligibility for a premium tax credit if enrolled in a Marketplace health insurance plan

- Assessment of 3.8% surtax on net investment income

To the extent you are able to control AGI, you want to keep this as low as possible.

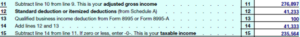

Deductions

Line 12a lists either the standard deduction or your itemized deductions, which will reduce your AGI. Under current tax law, only about 10% of taxpayers itemize deductions. If you do itemize, you will also include Schedule A with your return, which lists each of the deductions you are eligible to claim.

Line 13 is used if you had a deduction for Qualified Business Income (QBI). Owners of a passthrough trade or business, including partnerships, S Corps, sole proprietorships and some rental properties may exclude up to 20% of their net QBI. Income from REITs and Publicly Traded Partnerships (PTPs) are also included. There are numerous restrictions on the QBI deduction, which can reduce or eliminate it in many cases.

Subtracting the deductions on lines 12 and 13 from your AGI give you your taxable income, which is shown on Line 15. Your taxable income is the amount used to calculate your tax liability.

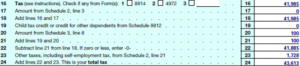

Tax Liability

Lines 16-38 of Form 1040 calculates your tax liability, lists any credits you are entitled to, and determines the amount of your refund or the amount you owe.

The tax due from ordinary income and/or capital gains and qualified dividends is calculated on Line 16. This can be a complicated calculation, so leave it to your CPA or tax prep software!

If you are subject to AMT or had received a larger premium tax credit from the health insurance marketplace than you were entitled to based on your actual income, those amounts would be reflected on Schedule 2 Part 1 and Form 1040 Line 17.

If you had dependents that qualified you for a child tax credit or the credit for other dependents and you were below the income threshold, that credit would be listed on Line 19.

Nonrefundable tax credits will be listed on Line 20, which are calculated in Part I on Schedule 3. If you have international investments in a taxable account, it is likely you would qualify for at least a small Foreign Tax Credit, which is shown on Line 1 of Schedule 3.

Line 23 of Form 1040 brings in “Other Taxes” from Part II of Schedule 2, including self-employment tax, the additional tax on tax-favored accounts (10% early withdrawal penalty), the 3.8% Medicare surtax on net investment income from Form 8960 and the 0.9% Medicare surtax on wages from Form 8959.

Your total tax is calculated on Line 24. This is the total amount of your tax liability for the year.

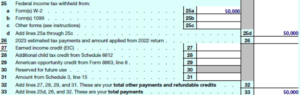

Tax Payments

Tax payments made during the year and refundable credits are listed on lines 25-32.

Withholding is listed on Lines 25a-c. If you had tax withheld from W-2 wages, that amount appears on Line 25a. Withholding reported on Form 1099, which includes funds withheld from retirement account distributions, pensions, or Social Security is listed on Line 25b.

If you made quarterly payments during the year or chose to apply at least a portion of last year’s refund to this year’s taxes, those amounts are shown on Line 26.

Other refundable credits not listed directly on Form 1040 and certain other tax payments come from Part II of Schedule 3 and are reported on Line 31.

The total of your tax payments made during the year and refundable credits are shown on Line 33 of Form 1040.

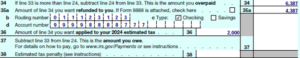

Are You Getting a Refund or Do You Owe Money?

If your tax payments (Line 33) exceed your Total Tax (Line 24), you are entitled to a refund. Line 34 shows the refund amount. You can elect to have that amount paid back to you, you can apply it to next year’s estimated tax liability, or a combination of the two. Line 35a lists the amount you want paid to you. Line 36 lists the amount you want credited to next year’s tax liability.

If your tax payments (Line 33) are less than your Total Tax (Line 24), you owe tax. The amount you owe is shown on Line 37. If you did not pay enough tax during the year and owe an underpayment penalty, that amount is shown on Line 38.

A full sample of a Form 1040 is listed below. Click the image to advance to the second page.

Now that you know the basics, take 10 minutes and review your tax return. Do all of the numbers make sense? If not, give us a call and we can walk through the tax return in an upcoming meeting. The better you understand the outcome of your tax return, the easier it may be to answer your accountant’s questions and pull together documentation. Happy Tax Season!