Estate Planning for Blended Families

Written By: Bill Lyne, Lyne Law Firm, LLC

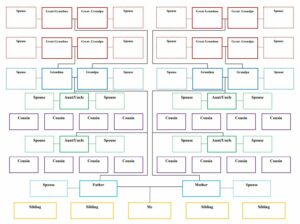

When two people get married and one or both have children from a prior relationship, a “blended family” is created. While a blended family is cause for celebration, members of those families are among the clients who need estate planning the most.

Absent estate planning documents, the law confers property rights on spouses at death. For example, under Wisconsin law, when a couple has no children, upon the death of a spouse, the surviving spouse is entitled to the property of the deceased spouse. Whereas, if one spouse dies with a child or children from a prior relationship, the surviving spouse is entitled to one-half of the deceased spouse’s property and prior children are entitled to the other half.

Additionally, there are emotional bonds between a parent and children from a prior relationship, commitments made to a deceased spouse and oftentimes legal obligations related to children in a divorce.

Proper estate planning for blended families takes into consideration the emotional, financial and legal realities related to the end of one relationship, while balancing and considering each member of the new blended family.

There are a number of tools used in modern estate planning to address the concerns of blended families, including: premarital and post-marital property agreements, trusts and titling of assets.

Marital Property Agreement

A marital property agreement (MPA) may be entered into before or during a marriage. The purpose of the MPA is to provide clarity as to the property rights of each spouse. For example, a MPA could say that all property brought to a marriage by one spouse will always be his or her individual property; or, alternatively, the MPA could say that upon marriage all property brought to the marriage will be marital property (where each spouse has a one-half economic interest). Having a proper MPA can eliminate confusion over what was owned by a spouse at death and whether he or she may direct that property to children from prior relationships or to the surviving spouse.

Trusts

Trusts are commonly used in estate planning for blended families. Trusts may provide that upon the death of a spouse, some part or all his or her property will be held for the lifetime benefit of the surviving spouse; and at the death of the surviving spouse, the remaining trust assets could be directed to the children of the first spouse to die. There are many different trust designs that may be employed. The most common are referred to as “marital trusts” and “family trusts”. Marital trusts provide for only the surviving spouse during his or her lifetime (and then provide for prior children) and may provide tax benefits to the ultimate beneficiaries of such trusts. Family trusts may provide for the surviving spouse and other family members.

Titling of Assets

Proper titling of assets may provide benefits as well. By way of example, if a parcel of real estate were held by spouses as “marital property”, then at the death of a spouse, he or she may direct under his or her Will (or trust) who is to receive 50% of the property. But if the same property is held as “survivorship marital property,” then at the death of one spouse, the other spouse will own 100% of the property, by operation of law. So, titling is a powerful tool in estate planning, especially for blended families.

There are several other things to keep in mind in estate planning for blended families. First, remember that under law, divorce generally terminates a former spouse’s rights as a beneficiary under a Will of the other and nullifies their appointment to serve in a fiduciary position (personal representative, agent, trustee). Second, under law, adopted children are treated as being in your bloodline, while stepchildren are not. So, if you want to include stepchildren as beneficiaries of your estate, you must specifically do so under the terms of your Will or revocable trust.

While it is not possible to cover in this space all the potential issues in estate planning for blended families, rest assured that with proper thought and planning it is possible to ensure the lifestyle of a surviving spouse while protecting a legacy for children from prior relationships.