How Income Impacts Medicare Premiums

Written By: Brian Ellenbecker, CFP®, EA, CPWA®, CIMA®, CLTC®

Turning 65 is a milestone birthday. In the United States, that is the age where most people first become eligible for Medicare. Medicare offers comprehensive coverage at a reasonable price, providing a very strong option for most people. However, there are costs associated with coverage. Premiums increase for Part B (Medical Coverage) and Part D (Prescription Drug Coverage) as your income hits certain levels. The additional premium you pay due to higher income is referred to as the Income-Related Monthly Adjustment Amount (IRMAA).

IRMAA is one of the trickier Medicare-related items, but proper income planning may be able to keep your premiums lower. Because you may be able to manage your income and therefore limit your premium increases, it’s important to understand the key aspects of IRMAA.

What is IRMAA?

Once your modified adjusted gross income (MAGI = adjusted gross income + tax-exempt interest) exceeds $97,000 for single filers or $194,000 for joint filers, the amount you pay for Medicare Parts B & D starts to increase.

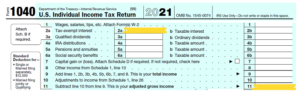

To calculate your MAGI, add lines 2a and 11 from your 1040. Income from two years prior is used to calculate your current year premiums. For example, 2020 income determines 2022 Medicare premiums while your 2021 income will determine your 2023 premiums.

This makes it important to start planning before you turn 65 as your premium will be determined from your income two years prior to this milestone birthday.

IRMAA Income Tiers

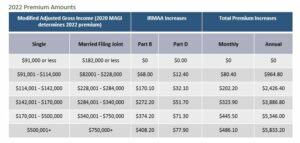

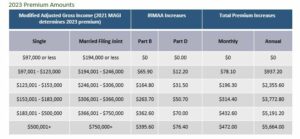

The table below shows the IRMAA brackets and resulting premium increases for 2022 and 2023.

The premium increases are meaningful, especially at higher income levels. The above tables reflect the increases for an individual. If you’re married and both spouses are on Medicare, you would double the amount of the increase, as it applies to both spouses.

Note that if you go into the next bracket by even $1, you will be forced to pay the extra premium amount. When making income projections, give yourself a sufficient buffer to allow for unexpected income that might come in.

Life-Changing Events

There are certain events that might occur in your life that allow you to appeal an IRMAA assessment and potentially have your premium reduced. The Social Security Administration (SSA), which administers the IRMAA portion of Medicare, recognizes the following life-changing events:

– Marriage

– Divorce/Annulment

– Death of Spouse

– Work Stoppage

– Work Reduction

– Loss of Income-Producing Property

– Loss of Pension Income

– Employer Settlement Payment

If your income was higher two years ago than it is today due to one of the above events, you can notify SSA of the change via an appeal. If they acknowledge your lower income, then your Medicare premium will be reduced accordingly.

To file an appeal with SSA, you file Form SSA-44. Optionally, you can also include a letter of explanation. The form does a nice job of explaining how to fill out each section. Contact SSA prior to submitting the form to ensure you follow their process and procedures correctly.

Income Planning Strategies

Reducing your income to avoid IRMAA can be trickier than it sounds. In most cases the only way to reduce your gross income is to avoid taking the income in the first place. If you need that income to meet your expenses, you may not have the option of just “not taking it”.

Fortunately, there are a few strategies that some people may have at their disposal that may help them control their income and avoid paying more in Medicare premiums.

1) When choosing a source to withdraw funds from, consider a tax-free source if one is available. Tax-free options include withdrawals from a Roth IRA, the withdrawal of basis from the cash value of a life insurance policy, or selling stocks that are at a loss (or can be offset by current or future losses).

2) Be flexible with spending and/or spread out large withdrawals. Accelerating or deferring expenses and the resulting income you need to fund those expenses into a different tax year where your income is otherwise lower could help you avoid a rise in Medicare premiums.

3) If a relatively large withdrawal is required to fund an upcoming expenses, try to spread it out over multiple tax years. For example, if you intend to buy a car in January, withdraw half the money in December and half in January.

4) Pay medical expenses with health savings account (HSA) funds. If you have a health savings account that you’ve been deferring withdrawal from, use those funds to pay for qualified medical expenses. If you have medical expenses that you’ve incurred in past years, you may also take tax-free withdrawals for those. To take a qualified withdrawal for health expenses from a prior year, the HSA must have been in existence when the expense originally occurred and you should have documentation of that expense, in case the withdrawal is questioned.

5) If you are over 70½ and make donations to charity, consider making qualified charitable distributions (QCDs) from your IRA. These distributions do not count as income and can also satisfy your required minimum distribution. Each IRA owner can make a QCD of up to $100,000 per year.

6) While most deductions do not reduce your AGI, there are a handful of “above-the-line” deductions that do. The most common ones are deductible contributions to an IRA and HSA account. Others include student loan interest, self-employment costs and school tuition and fees.

7) While not an income reduction strategy, if you’re already subject to IRMAA, consider filling up that bracket with additional income. You could either save the funds for future expenses or consider other techniques like Roth IRA conversions. However, be careful of other possible negative tax impacts. Work with your tax advisor before implementing any of these strategies.

If you have questions on Medicare or how IRMAA might impact you, please reach out to your Shakespeare financial advisor to discuss your personal situation in more detail.