Milestone Birthdays for Financial Planning

Written By: Ryan Rink, CFP®, EA, ChFC®, CLTC®

Birthday celebrations may not be top of mind as you get older, but understanding key birthdays may help you better prepare for financial planning milestones. Perhaps more importantly, keeping track of important age changes can help you avoid possible penalties if you miss the date. Below is a list of birthdays during your retirement planning years that are important to note:

Age 50

– In the year you turn 50, you are eligible to make catch-up contributions to retirement accounts such as IRAs, 401(k)s and SIMPLE IRAs.

– Each person is able to contribute an additional $1,000 to their IRA, bringing the maximum 2023 contribution amount to $7,500.

– For 401(k), 403(b) and 457(b) accounts, you are able to contribute an additional $7,500, bringing the maximum 2023 contribution amount to $30,000.

– For SIMPLE IRAs, you are able to contribute an additional $3,500, bringing the maximum 2023 contribution amount to $19,000.

Age 55

– In the year you turn 55, you are eligible to make catch-up contributions to Health Savings Accounts (HSAs).

– Each person can contribute an additional $1,000 to their HSA in 2023. For the typical married couple, one person has a ‘family’ HSA through their employer. In this instance, they are eligible to contribute up to $7,750, plus the additional $1,000 catch-up to their HSA. If that person’s spouse is also over 55, they are eligible to make an additional $1,000 catch-up contribution, however the funds would have to be deposited in a separate HSA where the spouse is the owner. If you are single, you’re eligible to contribute $3,850, plus the additional $1,000 catch-up.

Age 59.5

– Once you turn 59.5, you are eligible to withdraw from retirement accounts without the 10% early distribution penalty. This applies to IRAs and qualified retirement accounts (401(k), 403(b), etc.).

Age 60

– Once you turn age 60, you are eligible to claim Social Security survivor benefits as a widow/widower.

Note: This is the earliest you can claim survivor benefits – each month you wait, the benefit amount increases. The amount you receive is primarily based off the deceased person’s Full Retirement Age amount.

Age 62

– Once you turn age 62, you are eligible to claim Social Security retirement benefits.

Note: This is the earliest you can claim your Social Security benefits – each month you wait, the benefit amount increases.

– If you are still working, it often does not make sense to begin drawing your Social Security until you retire. This is because you are only allowed to earn up to $21,240 (in 2023) of income until you reach Full Retirement Age, otherwise benefits are clawed back.

Age 65

– Once you turn age 65, you are eligible for coverage under Medicare. The Initial Enrollment Period for Medicare begins 3 months before you turn 65 and ends 3 months after your 65th If you miss enrolling during this 7-month window, you may need to pay a late enrollment penalty for the remainder of your life.

Note: There is a Special Enrollment Period for individuals who are still working at age 65 and are on their employer’s health insurance.

Age 67

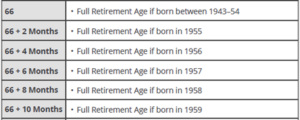

– If you were born in 1960 or later, age 67 is your Full Retirement Age (FRA) for Social Security purposes – for those born between 1943-1959, your FRA is age 66 (see below for specifics):

– Full Retirement Age is the age when you are entitled to 100% of your Social Security benefits, which are determined by your lifetime earnings. The amount you receive when you first get benefits sets the base for the amount you will receive for the rest of your life. Benefits are often adjusted for inflation each year.

– If you will reach Full Retirement Age in 2023, the maximum amount of earnings for the months before FRA is $56,520. Upon reaching FRA, there is no limit on what you can earn and still receive your full Social Security benefits.

Age 70

– This is the age when your maximum Social Security benefit is reached. Your benefit will not increase any further if you choose to delay claiming past your 70th

Age 70.5

– Once you turn age 70.5, you are eligible to make Qualified Charitable Distributions (QCDs). Each year, you are permitted to donate up to $100,000 to one or more charities directly from your taxable IRA account. The key benefit is you are not taxed on the distributions.

Note: These donations count towards your Required Minimum Distribution (once you begin your RMDs).

Age 73

– If you were born before 1960, you must begin taking Required Minimum Distributions (RMDs) from your qualified retirement accounts (IRAs, 401(k)s, 403(b)s, etc.) in the year you turn 73.

– The government requires individuals to take these mandatory distributions each year so they are finally able to tax the money, which had been growing tax-deferred to encourage saving for retirement.

Age 75

– If you were born in 1960 or later, your Required Minimum Distribution start date is the year you turn 75.

If you have questions regarding any of the specific milestone ages, please reach out to your Shakespeare Advisor at 262-814-1600.