Rebalancing Reduces Risk and Increases Your Portfolio Returns

Our investment committee meets on a regular basis to evaluate our investment management practices and to ensure that our strategies are still the optimal way to manage your portfolio. Over the last several months, we have evaluated our rebalancing strategy, including how frequently we should rebalance your portfolio.

Before we dive into the technical details, let's review the basics:

- Asset Class Weightings. Our clients have a very specific equity to fixed income ratio based on their unique circumstances (stage of life, income needs and sources, and risk tolerance). Someone early in their career may have more equities than someone nearing retirement. Our clients know this ratio as their "model." As an example, a 60/40 model is a portfolio that has 60% of assets directed toward equities and 40% directed toward fixed income securities and alternative investments. Managing the equity to fixed income ratio is the primary way we maintain the appropriate amount of risk in your portfolio.

- Fund Allocation. After establishing a client's model portfolio, the next step is to establish which funds go into the portfolio and how much of each fund you should own. The percentage that each fund receives is called the targeted allocation, which we are monitor daily.

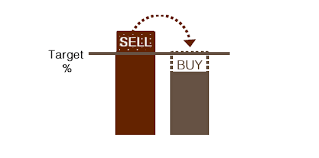

- Rebalancing. What exactly is rebalancing? Rebalancing is analyzing your portfolio on a regular basis to determine if the asset classes or the individual holdings have strayed from the targeted allocation; and then selling or buying assets to bring the portfolio back to the targeted allocation. More simply said, selling some of what went up and buying more of what didn't.

This concept is simple enough, until you try to prove how often you should rebalance and how much you should let each investment stray in the meantime. We know that assets will shift each day depending on market movement; but it is impractical to trade every day. Trading too frequently can have a negative impact in certain markets and create unneeded trading costs and taxes. Therefore, we set out to determine how far we should let assets stray from their targets and how often we should trade.

The Journal of Financial Planning (JFP) is a source we turn to for peer-reviewed technical articles summarizing the latest industry research. Here we found one article that helped us develop our rebalancing strategy.

The article written by Gobind Daryanani CFP, PHD in Journal of Financial Planning discussed not only the ideal frequency of rebalancing, but also how far each asset should be allowed to stray from its targeted allocation. Through much research, Daryanani found that portfolios should be looked at frequently (every 10 trading days) and allow for a 20% "band" around each investment before rebalancing.

Dr. Daryanani's research made sense to our committee as long as our clients' equity to fixed income ratio stayed in line with the appropriate model. Therefore, in addition to rebalancing any individual holding if it strays 20% from the targeted allocation, we will also place trades if the equity to fixed income ratio moves 5 percentage points from its target. For instance, if your targeted allocation has 60% in stocks and 40% in fixed income, we will be rebalancing your portfolio if it shifts to 66/34 or 54/46.

Dr. Daryanani's research made sense to our committee as long as our clients' equity to fixed income ratio stayed in line with the appropriate model. Therefore, in addition to rebalancing any individual holding if it strays 20% from the targeted allocation, we will also place trades if the equity to fixed income ratio moves 5 percentage points from its target. For instance, if your targeted allocation has 60% in stocks and 40% in fixed income, we will be rebalancing your portfolio if it shifts to 66/34 or 54/46.

The Daryanani research was also evaluated by industry expert, Michael Kitces in Kitces - Rebalancing, who reached the same conclusions.

Once we established our rebalancing practices, we realized the challenges required to implement it. As a solution, we sought out the latest technology to facilitate not only our rebalancing strategy, but also daily monitoring of your portfolios. After an extensive search, we identified that Tamarac rebalancing software met our key goals. These include being able to monitor the allocation of each portfolio on a daily basis - being flexible to match our specific strategies described above, and allowing us to be sensitive to taxes. In other words, we found the latest software that allowed us to implement all aspects of our investment strategy. Earlier in May, Andrea and Mark traveled to Chicago for intensive two-day training on the Tamarac software. We expect to be fully operational with the software in the next two weeks.

While much of this sounds complicated (and it is), rest assured that we have done the dirty work. We're confident that we are using leading edge technology to implement our research based investment methods to ensure your portfolio maintains an appropriate amount of risk while capturing maximum returns. The end result is an increased peace of mind knowing we are doing everything possible to help you achieve your financial goals.

-Andrea