Have US Stocks Risen Too Far and Too Fast?

Large-cap US stocks were up more than 13.5% for the most recent decade, 2010 – 2019. This is above historical averages - so should we be concerned the market has advanced too far and too fast? Let’s dig a little deeper for a more complete perspective.

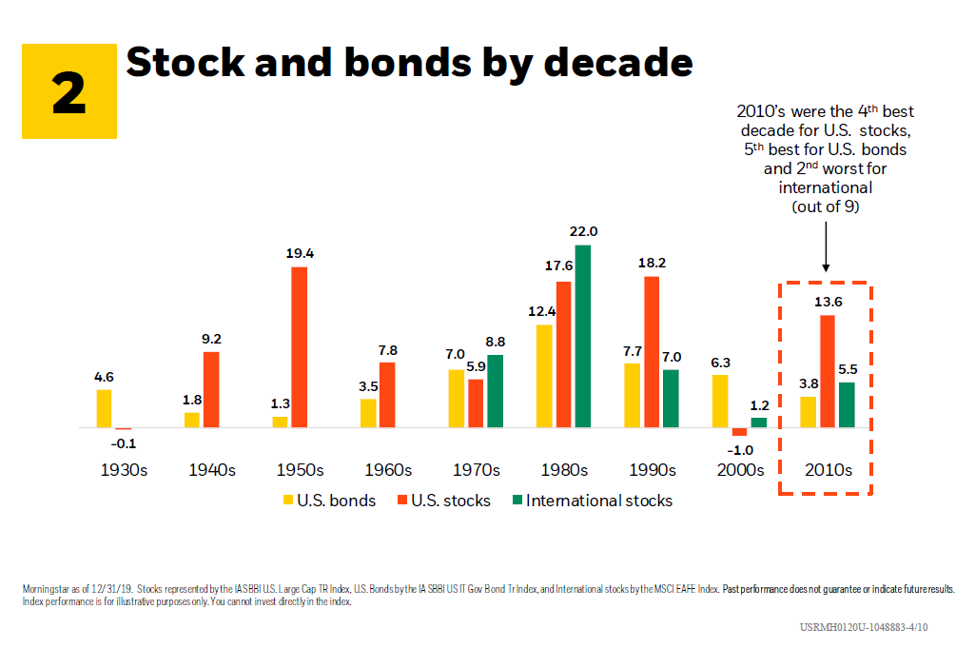

The first thing to note is that the last ten-year period was only the fourth best decade in US history. The top three decades were the 1950s (19.4%), 1990s (18.2%) and the 1980s (17.6%). Notice the strong returns of the 1980s were followed by an even better decade of the 1990s. It’s conceivable that the next 10 years could not only provide positive returns, but possibly even stronger returns than what we have just experienced.

We all remember the credit crisis that hit the markets in 2008, causing declines of over 30% for equity markets around the world. Looking at the 13.5% return we mentioned for the last decade, if we shift the start date two years to begin on 1/1/2008, the twelve-year performance (2008-2019) for large cap US stocks drop to 6.79%. Amazing how two additional years can reduce the number by 50%. Striving for an even longer perspective, if we look at the previous 20 years, 2000-2019, the average return for US large-cap US Stocks is an even more modest 4%. No one would argue 4% average market returns are worrisome, and that’s exactly what we have experienced.

Lastly, please note that we have been referencing US large-cap equities for this discussion. We haven’t mentioned mid-cap, small-cap, or international equities. International equities for the 2010-2019 decade provided a modest 5.5% average return. If we begin the analysis in 2008, the twelve-year return for international equities is a dismal -0.84% return, hardly indicating a market that has moved too far or too fast.

Side note: What’s most interesting in this comparison of US and International markets, is that human nature wants to believe that the good returns of the US equity markets are unsustainable; yet the dismal returns of international markets denote a bad investment that should be avoided moving forward.

Large-cap US equities are only one component of client portfolios, which include fixed income and the other equity asset classes mentioned above. Shakespeare is committed to moderating client risk by diversifying across various asset classes and rebalancing portfolios when certain assets grow (or shrink) faster than others. In a way, we like it when markets move too far and too fast because that gives us an opportunity to use our value-added rebalancing discipline.

PS: We are getting lots of questions (and comments) about what might happen to the stock market based on the November 2020 presidential election. The reality is that Presidents have little impact on the long-term performance of the markets. Markets are driven by earnings and innovation, not politics; and financial markets find a way to ‘grow forward’ in any and all economic and political conditions.